Senate Bill 1059

RE: IMPORTANT TAX UPDATES RELATED TO THE PASSAGE OF CALIFORNIA SENATE BILL 1059 (SB 1059) FOR CANNABIS BUSINESSES

On September 28, 2024, Governor Newsom signed California Senate Bill 1059 (SB 1059) which added new section 16005 to the California Business and Professions Code. The changes introduced by the bill will directly impact how cannabis operators calculate and report their taxable receipts. The City will abide by the dictates of SB 1059 so long as it remains California law.

Summary of Changes under SB 1059:

Effective Date: The provisions of SB 1059 will take effect on January 1, 2025. The updated methodology will apply to the February 2025 tax filing deadline, which pertains to receipts from January 2025. Cannabis operators should ensure they are familiar with the new tax calculation and reporting requirements imposed by SB 1059 that will be in place from this date forward.

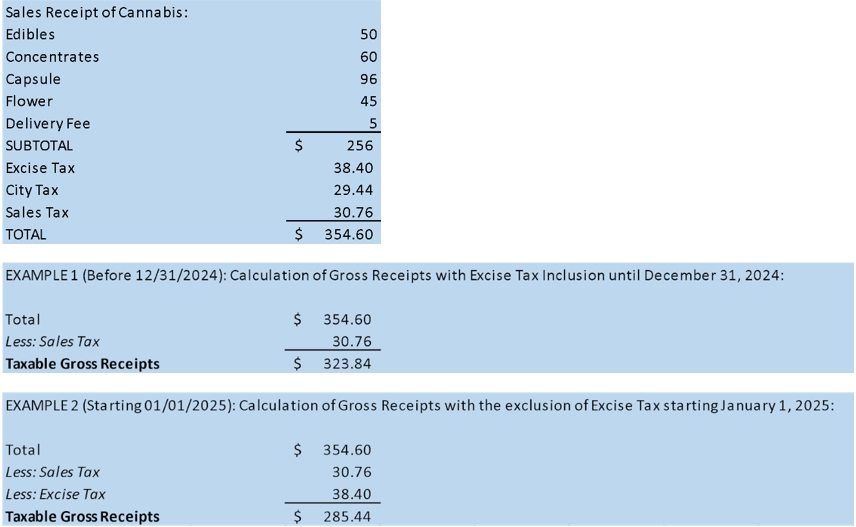

Excise Tax Exclusion Starting January 1, 2025: Beginning January 1, 2025, cannabis operators should no longer include the state cannabis excise tax as part of their taxable receipts when reporting its gross receipts to the City.

Excise Tax Inclusion until December 31, 2024: Until December 31, 2024, cannabis operators are required to include the excise tax as part of gross receipts when calculating taxes as City law requires. The excise tax must continue to be factored into gross receipts for City tax reporting purposes until the end of this year.

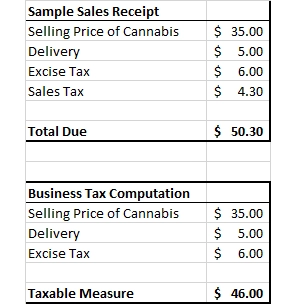

City-Imposed Taxes Remain Taxable: While SB 1059 provides that the state excise tax will no longer be included in computing and measuring a cannabis operator’s taxable receipts starting in 2025, the City’s cannabis gross receipts tax on cannabis operators is not otherwise impacted by SB 1059. SB 1059 did not impair or prohibit the imposition or collection of any local tax from cannabis sales.

To ensure compliance, we recommend that Cannabis operators review SB 1059 with your tax advisor (if any) and begin reviewing their tax practices. This includes preparing to adjust how taxable receipts are calculated starting in 2025 and ensuring that excise tax is properly included in receipts until the end of 2024.

Examples of these calculations are provided below as a reference guide only.