UNDERSTANDING POSTMARKS

City of Los Angeles Business Tax payments must be received or United States Postal Service (USPS) postmarked by the delinquency date to avoid penalties. Otherwise, the payment is delinquent and penalties will be imposed in accordance with State law.

Business Taxes (Annual)

If we receive your payment after 5:00 p.m. in one of our offices on February 28th or your payment is USPS postmarked after February 28th, we will impose a 5% percent penalty, which will increase monthly (Effective January 1, 2002, the penalty payable on delinquent taxes will be applied at 5% of the principal amount due on the first day of each of the first four months of delinquency. For those businesses more than four months delinquent, an additional 20% penalty is imposed for a total penalty of 40% for long-term delinquents.) INTEREST: If any tax due is not paid timely (see above), interest at the rate of 0.5% per month shall apply to the principal tax due until paid. Interest applies only to the principal tax due and not to any penalty incurred for delinquency.

Business Taxes (Monthly and Quarterly)

If we receive your payment after 5:00 p.m. in one of our offices by due date or your payment is USPS postmarked after due date, we will impose a 5% percent penalty, which will increase monthly (Effective January 1, 2002, the penalty payable on delinquent taxes will be applied at 5% of the principal amount due on the first day of each of the first four months of delinquency. For those businesses more than four months delinquent, an additional 20% penalty is imposed for a total penalty of 40% for long-term delinquents.) INTEREST: If any tax due is not paid timely (see above), interest at the rate of 0.5% per month shall apply to the principal tax due until paid. Interest applies only to the principal tax due and not to any penalty incurred for delinquency.

Police Alarm Permit (Annual)

If we receive your payment after 5:00 p.m. in one of our offices on December 31st or your payment is USPS postmarked after December 31st, a late penalty of $15 will be imposed for renewing your alarm permit from January 1 to March 31st. Alarm permits renewed after March 31st will be assessed a late penalty of $30, in addition to the renewal fee.

WHAT TO LOOK FOR

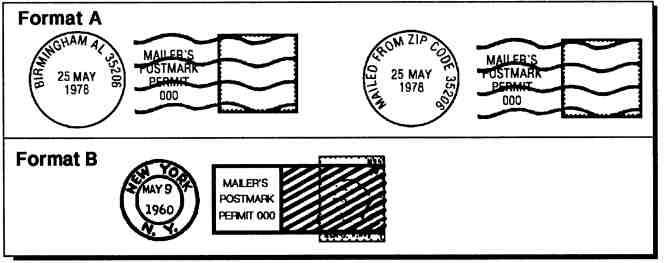

Postmarks are imprints the USPS applies to letters, flats, and parcels to reflect the date, name, state, and zip code of the USPS office that accepted custody of the mail. The postmark is generally applied either by machine or by hand, with cancellation bars and is primarily used to prevent postage from being re-used.

Taxpayers who send their payments by mail are cautioned that the USPS only postmarks certain mail depending on the type of postage used. Additionally, the USPS may not postmark mail on the same day it is deposited by a taxpayer.

MAIL THAT IS POSTMARKED

STANDARD POSTAGE STAMPS

Stamps purchased and affixed to mail as evidence of the payment of postage.

MAIL THAT IS NOT USPS POSTMARKED

Normally, USPS will not postmark these type of imprinted stamps, however on occasion when USPS does postmark the imprinted stamps our office will use the USPS postmark date.

METERED MAIL

Mail on which postage is printed directly on an envelope or label by a postage machine licensed by the USPS. Many private companies use these types of postage machines.

PRE-CANCELED STAMP

Stamps sold through a private vendor, such as stamps.com®.

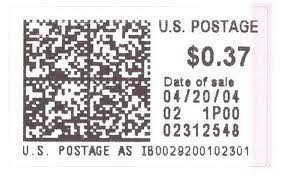

AUTOMATED POSTAL CENTER (APC) STAMPS

Stamps, with or without a date, purchased from machines located within a USPS.

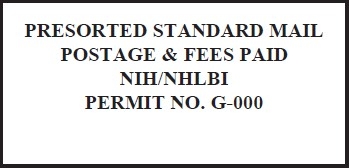

PERMIT IMPRINT

Pre-sorted mail used by bill pay services, such as online home banking.

RECOMMENDED OPTION

POSTAGE VALIDATED IMPRINE (PVI) Label

Postage which is purchased from a USPS retail counter or window. The PVI is applied to a piece of mail by personnel at the retail counter or window when postage has been paid to mail that item. The items is retained in USPS custody and is not handed back to the customer. The date printed on the PVI label is the date of the mailing.